Sponsoring Partner’s Message

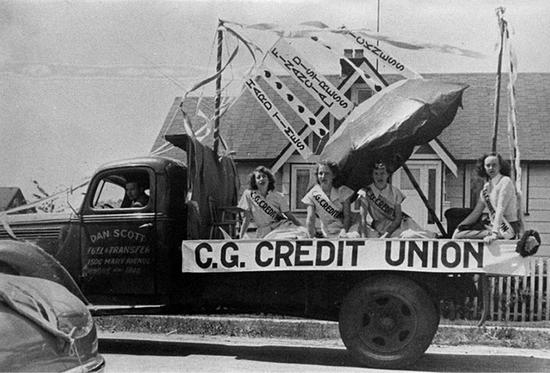

Community Savings began in the imagination of woodworkers attending a union meeting. Following a guest presentation from the treasurer of the Common Good Credit Union, ten IWA members from the New Westminster local took up the cause. By May 18, 1944, less than two months after the project was first discussed, the IWA (New Westminster) Credit Union was born. Needless to say, this co-operative venture enjoyed considerable support. Today’s observer might wonder why.

If one considers the stratification of early to mid-twentieth-century society, the need becomes obvious. Workboots and hard hats were rarely seen inside the oak walls and marble halls of BC’s financial institutions. Banks were not serving wage earners well, if at all. Workers and their families needed a place where they could both save and borrow.

At the time, traditional savings accounts showed little or no return. Yet credit union members of the 1940s received patronage dividends averaging 5 percent and share dividends of 3 percent. These dividends were probably the first interest payments workers would have earned, and the rates certainly exceeded bank interest.

"“Yes, the long memory is the most radical idea in this country. It is the loss of that long memory which deprives people of the connective flow of thoughts and events that clarifies our vision, not of where we’re going, but where we want to go.”

—Utah Phillips, American labour organizer, folk singer, storyteller, poet

"

On the lending side, the co-operative credit union philosophy was unique in the financial world: credit was extended primarily based on character, not wealth. People banded together to save money but they loaned it too. While collateral was weighed, the fundamental issue was how your peers thought of you. That character counted was a powerful idea.

In the language of the day, IWA Credit Union members needed loans for “providential purposes” first. In response, their credit union offered them “accommodation loans” of $10 to $50, to tide them over until the next payday. Early records show loans were then made for car purchases, furniture, house repairs, construction, insurance, funerals and most telling of all, medical expenses. There were few delinquencies.

Following a membership vote to provide “temporary office space,” Community Savings found its first home in the local union office. A month later IWA members voted to install a door, “so the credit union could be locked up.” This “temporary” arrangement lasted for several years until the credit union moved to 12th Street in New Westminster, near where a branch exists to this day. By the end of 1945 the credit union was well on the way. Embracing the co-operative spirit, rank-and-file members elected their first woman officer, Ellen Mitchell, at the December annual meeting.

After those beginnings, Community Savings merged with other “union bond” financial co-operatives. The credit unions of the Distillery Employees, Longshoremen’s & Warehousemen’s Union, Federal Civil Servants, Victoria Labour Council, Utilco and Operating Engineers became part of the whole. In 1977 the credit union became “open bond,” and in 1999 was renamed “Community Savings” to reflect the wider base of membership. With branches in New Westminster, Surrey, Port Coquitlam, Bur-naby, Vancouver and Victoria, its geographic presence has grown as well. But Community Savings continues to be governed by the union members of its board and union principles in its practice.

While many union workers, leaders and their organizations are members of Community Savings, none was more beloved than Jack Munro. Long after his retirement from the presidency of IWA Canada, he remained active in the workers’ cause. On a day not so long ago, Jack arrived at the Vancouver branch and announced the BC Labour Heritage Centre was going to write a history of BC workers. As always, his enthusiasm was infectious. Sadly, fate had other plans.

Jack Munro’s passing was hard. He had always been there—tough and kind in equal measure. Genuine and smart, he was a working-class hero. In the wake of Jack’s passing, Community Savings’ board of directors passed a motion to fully fund this history. “It was the least we could do,” they said, “for a brother who gave so much.”

From founding to present day, Community Savings’ story is but one of countless histories—lived and supported by the collective action of British Columbia’s working people and their unions. We hope you will take inspiration and heart from their tale.

Members, Board and Staff

Community Savings Credit Union